Retirement might feel far away. Maybe it’s 10 years out. Maybe 30. But here’s the truth: the earlier you plan, the easier it becomes.

Retirement isn’t just about stopping work. It’s about freedom. Freedom to travel. Freedom to spend time with family. Freedom to live without financial stress.

And that freedom doesn’t happen by accident. It happens through smart, consistent retirement planning.

In this guide, we’ll break down practical retirement planning strategies to help you maximize your savings in 2026 and beyond. Whether you’re just starting or catching up, there’s something here for you.

Let’s get started.

What Is Retirement Planning?

Retirement planning is the process of preparing financially for life after full-time work.

It involves:

- Estimating future expenses

- Saving and investing regularly

- Choosing the right retirement accounts

- Managing risk

- Planning withdrawals

Think of retirement planning like building a house. You don’t just throw up walls. You lay a strong foundation, build carefully, and protect it from storms.

The earlier you start building, the stronger your financial house becomes.

Why Retirement Planning Matters More in 2026

The world is changing.

- People are living longer.

- Healthcare costs are rising.

- Traditional pensions are rare.

- Inflation reduces purchasing power.

In 2026, relying solely on Social Security is not enough for most people.

Here’s a simple example:

If you need $60,000 per year in retirement and Social Security provides $25,000, you still need $35,000 annually from savings.

That requires preparation.

Planning today protects your future self.

How Much Do You Need to Retire Comfortably?

There’s no universal number, but a common rule is the 25x rule.

Multiply your expected annual expenses by 25.

Example:

- Annual retirement expenses: $50,000

- $50,000 × 25 = $1,250,000

That’s your target retirement fund.

Another popular guideline is the 4% rule, which suggests you can withdraw 4% annually from your retirement portfolio without running out of money over 30 years.

Retirement isn’t about guessing. It’s about calculating wisely.

Top Retirement Accounts to Maximize Savings

Choosing the right account makes a big difference.

1. 401(k) Plans

Offered by employers.

Benefits:

- Employer match (free money)

- High contribution limits

- Automatic payroll deductions

In 2026, contribution limits remain higher than IRAs.

Always contribute enough to get the full employer match.

2. Roth IRA

Funded with after-tax dollars.

Benefits:

- Tax-free growth

- Tax-free withdrawals in retirement

Great for younger investors expecting higher future income.

3. Traditional IRA

Offers tax deductions today.

You pay taxes later during retirement withdrawals.

Comparison Table

| Account Type | Tax Benefit Now | Tax Benefit Later | Best For |

|---|---|---|---|

| 401(k) | Yes | No | Employees |

| Roth IRA | No | Yes | Long-term growth |

| Traditional IRA | Yes | No | Immediate tax relief |

Diversifying across account types can provide flexibility later.

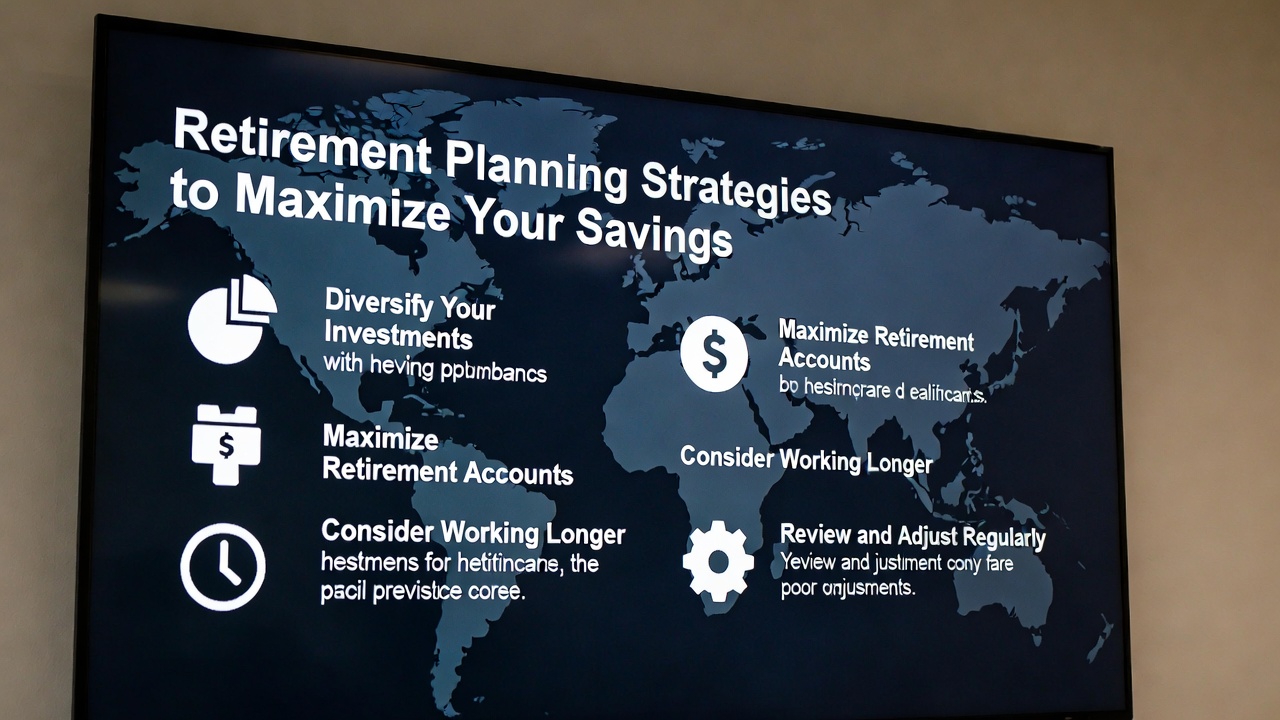

Powerful Strategies to Maximize Retirement Savings

Let’s talk strategy.

1. Start Early (Compound Interest Is Magic)

Compound interest means you earn returns on your returns.

Example:

Invest $300 per month at 8% return:

| Years Invested | Total Value |

|---|---|

| 10 Years | ~$55,000 |

| 20 Years | ~$177,000 |

| 30 Years | ~$447,000 |

Time matters more than timing.

2. Increase Contributions Gradually

Start small if needed.

Then:

- Increase contributions by 1% annually

- Invest bonuses

- Redirect raises to retirement

Small increases compound significantly over decades.

3. Diversify Your Investments

Avoid putting everything in one stock.

A diversified portfolio may include:

- Index funds

- Bonds

- International stocks

- Real estate funds

Diversification reduces risk while maintaining growth potential.

4. Reduce Fees

High investment fees quietly reduce returns.

Compare:

| Annual Fee | 30-Year Impact on $500,000 |

|---|---|

| 0.20% | Lower impact |

| 1.50% | Tens of thousands lost |

Choose low-cost index funds when possible.

5. Delay Social Security (If Possible)

Waiting longer increases your benefit.

For many retirees, delaying from age 62 to 67 or 70 significantly increases monthly payments.

It’s like giving yourself a raise for life.

Common Retirement Planning Mistakes

Even smart people make these mistakes.

1. Starting Too Late

Time is your biggest advantage.

2. Underestimating Healthcare Costs

Medical expenses can be one of the largest retirement costs.

3. Being Too Conservative Too Early

Keeping everything in cash limits growth.

4. Ignoring Inflation

$50,000 today won’t buy the same amount in 30 years.

5. Withdrawing Too Much Too Fast

Overspending early can drain savings quickly.

Planning prevents regret.

How to Catch Up If You Started Late

It’s never too late.

Try these strategies:

- Max out contribution limits

- Use catch-up contributions (available after age 50)

- Reduce unnecessary expenses

- Delay retirement a few years

- Consider part-time work in early retirement

Even small adjustments can significantly improve your outlook.

Managing Risk as You Near Retirement

As retirement approaches, shift focus from growth to preservation.

Common approach:

- Younger investors: More stocks

- Near retirement: Balanced mix

- Retirees: Higher bond allocation

This strategy reduces exposure to major market downturns before withdrawals begin.

Example Retirement Plan

Imagine Mark, age 30.

- Contributes $400 per month

- Invests in low-cost index funds

- Increases contribution by 3% annually

By age 65, he may accumulate over $900,000 assuming moderate returns.

Consistency beats perfection.

Retirement Planning Is About Lifestyle

Ask yourself:

- Where do I want to live?

- Will I travel often?

- Do I plan to support family members?

Retirement planning isn’t just numbers.

It’s designing the life you want.

Conclusion

Retirement planning strategies to maximize your savings aren’t complicated. They require clarity, discipline, and consistency.

Start early. Contribute regularly. Diversify wisely. Reduce fees. Avoid emotional decisions.

Every dollar you invest today builds freedom tomorrow.

Retirement isn’t about stopping work. It’s about having the choice.

And that choice begins with smart planning today.

FAQs

1. When should I start retirement planning?

As early as possible. Even small contributions in your 20s make a big difference.

2. How much should I save each month?

Aim for 15%–20% of your income, if possible.

3. Is a 401(k) better than an IRA?

Both are useful. Employer match makes 401(k)s especially valuable.

4. What happens if the market crashes before I retire?

A diversified portfolio and proper asset allocation help reduce impact.

5. Can I retire early?

Yes, but it requires aggressive savings, disciplined investing, and careful withdrawal planning.