- Ancient Insurance Systems

- Babylonian Code of Hammurabi (1750 BCE) – Early risk-sharing contracts.

- Chinese merchant guilds (3rd millennium BCE) – Cargo loss distribution.

- Greek & Roman benevolent societies – Burial insurance.

- Maritime Insurance Beginnings

- Mediterranean traders (14th century) – First marine insurance contracts.

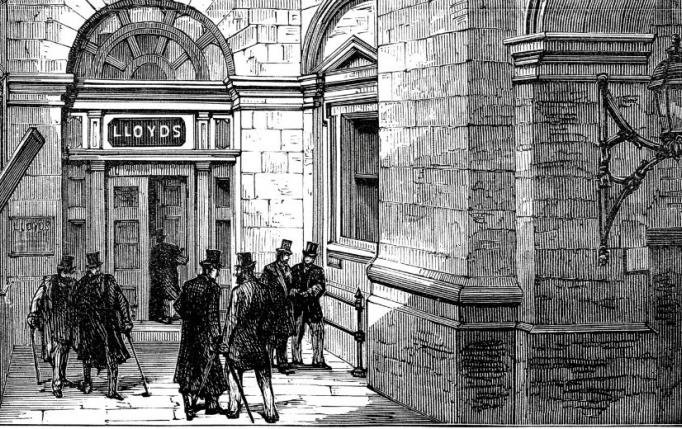

- Lloyd’s of London (1688) – Coffeehouse origins of modern underwriting.

🏛️ Evolution of Modern Insurance

- Fire & Property Insurance

- Great Fire of London (1666) – Led to fire insurance offices.

- Benjamin Franklin (1752) – Founded the first U.S. fire insurance company.

- Life Insurance Development

- Early tontines (17th-century Europe) – Pooled annuity systems.

- Equitable Life Assurance Society (1762) – First scientific life insurance.

- Health & Accident Insurance

- Industrial Revolution (19th century) – Worker injury coverage.

- Blue Cross/Blue Shield (1929) – Rise of health insurance in the U.S.

🌍 Regional Insurance History

- Islamic Insurance (Takaful)

- Mughal & Ottoman eras – Early mutual aid concepts.

- Modern Takaful (1979) – Sharia-compliant insurance.

- Insurance in Colonial America

- Philadelphia Contributionship (1752) – First U.S. property insurer.

- New York Fire Insurance (1787) – Post-revolution growth.

⚖️ Legal & Regulatory Milestones

- Key Insurance Laws

- British Marine Insurance Act (1906) – Standardized policies.

- U.S. McCarran-Ferguson Act (1945) – State vs. federal regulation.

- Notable Disasters & Insurance Impact

- San Francisco Earthquake (1906) – Bankruptcy of insurers.

- Hurricane Katrina (2005) – Modern claims challenges.

🚀 Modern Innovations

- 20th–21st Century Trends

- Automobile insurance (1920s) – Mass-market policies.

- Cyber insurance (2000s) – Digital risk coverage.

- AI & InsurTech – Automated underwriting.

📚 Research Ideas

- Compare ancient vs. modern insurance principles.

- Analyze how wars/diseases shaped insurance (e.g., Black Death, COVID-19).

- Case study: Lloyd’s of London’s role in global insurance.

Leave a Reply