Ages ago, in the days of yore, there was one thing that all people feared unanimously: the unknown. Merchants, farmers, traders, and even families feared the uncertainty—loss of valuable items, illness, and accidents. How were they to protect themselves from the uncertainty?

In the Babylonian Empire of 1800 BCE, something began to form. Merchants entered into a deal in the marketplace. They would pool the risk of sending goods on dangerous trade routes. When one of the merchants’ ships was lost at sea in a storm, others would chip in to assist in paying for the loss. It was not a large scam, but it was an early model of something that we would come to recognize as insurance.

As the centuries passed, this idea gained more support. The ancient Greek and Roman empires were aware that life itself was dangerous. The wealthy and powerful began to create guilds, which were basically early insurance pools. Members of the guild would take care of each other when it was needed—whether it was illness, death, or disaster. It was a simple idea: if we all contribute, we can all be insured.

Then came the Middle Ages, and more sea commerce. As ships ship out onto the open seas to distant locations, risks of travel were too visible. In the 14th century, Italian merchants, particularly from Venice and Genoa, began to formalize the practice of marine insurance. Imagine yourself on a bustling quay in Venice as ships were being loaded with valuable cargo—silk, spices, gold. But the seas were not secure. If a vessel was lost or seized by pirates, it would be catastrophe. Merchants thus started paying a little premium to a set of trustworthy partners against loss. This was the start of what we now refer to as marine insurance, and it caught fire in Europe.

Flash forward to 1688. Picture in your mind’s eye a boisterous London coffee house that provided a stop for traders, merchants, and sailors after work. That was where some of the traders began pooling their capital in a mutual fund to guarantee ships and ships’ cargos. They had no idea then, but this humble meeting point would evolve into Lloyd’s of London, perhaps the world’s most famous insurance market.

Lloyd’s insured ships, but ships were not all—eventually it insured any type of risk, from property to life. And so the modern insurance business coalesced, centuries of combined human wisdom and cooperation piled on top.

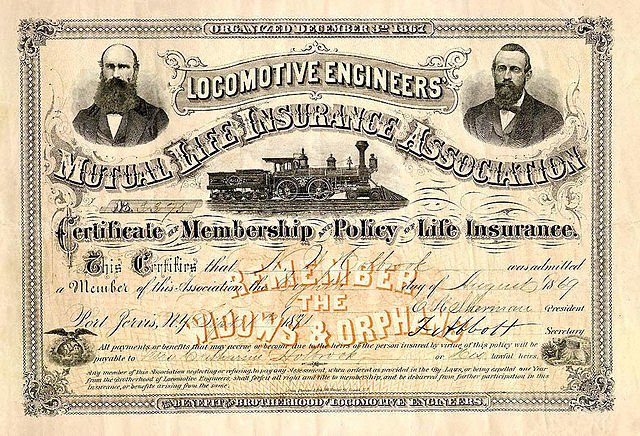

The industrial revolution had already started before the 18th century began, bringing with it a whole new type of risk. As the factories expanded, as the cities became filled to bursting, and as the middle class grew, people realized that they required new kinds of protection. That is when life insurance truly came into fashion. Just imagine a young Englishman concerned about what would happen to his wife and children if he did not survive work one day. Life insurance provided him with confidence in the fact that his loved ones would be catered for in the event that tragedy struck.

The 19th century was even more innovative. With the increasing rate of urbanization came an increased threat of accident and fire. The fire insurance companies emerged to provide insurance against one being completely lost in the event of a huge fire. Health insurance, however, began gaining momentum among factory workers in risky places and miners.

The history of insurance just grew more in the 20th century and up to the present. When automobiles became trendy, people wanted to insure their automobiles. When houses expanded, homeowners’ insurance was a requirement. When government programs like Social Security and Medicare were created, another security was offered to those who could not pay for it. The notion that we can insulate ourselves, our families, and our businesses from the uncertainties of life became more entrenched in society.

Today, however, with new dangers confronting the world—cyber attacks, global warming, and pandemics—the future of insurance is still to be written. With the assistance of technology, insurance has never been so bespoke and widespread as it is today, with on-demand insurance and online websites making it easier than ever before to insure the most precious things.

And so it is that the history of insurance—from its early days in primitive, community risk-sharing—has developed into the behemoth business we depend upon today. From the Babylonian merchant to today’s policyholder, insurance has always been, and will ever be, one thing and one thing only: protection against the unforeseen.

Leave a Reply